#W9 pdf signature how to

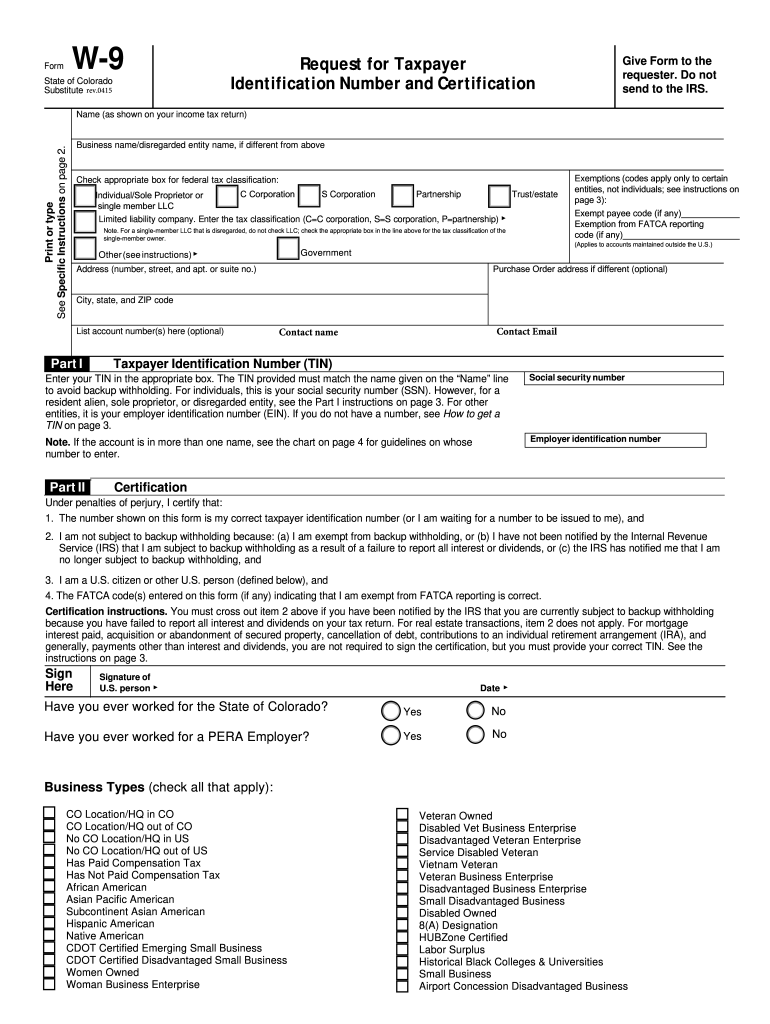

How to fill out a W-9 for a nonprofit corporation If not, W-9 forms and instructions can be found on the IRS’s website. The person or company that asked you to fill out a W-9 tax form may provide you with the form. If your nonprofit is asked to fill out a W-9 form, it should do so, even though your nonprofit has tax-exempt status. They use the taxpayer ID or Social Security numbers listed on the W-9 forms to ensure that they have accurately identified the business or person to whom payments were made. A W-9 is an Internal Revenue Service form that businesses use to obtain Social Security and taxpayer identification numbers from the people and organizations that they pay for services.īusinesses are required to report many of these payments to the Internal Revenue Service (IRS).

If your nonprofit corporation provides services to another business, you may be asked to fill out a W-9 form (Request for Taxpayer Identification Number and Certification).

0 kommentar(er)

0 kommentar(er)